Evolutionary Modeling and Analysis on Investment Consumption Optimization

DOI:

https://doi.org/10.55529/ijprt.227Keywords:

financial risk, genetic algorithms, evolutionary algorithms, data clustering, investment optimization, investment consumption, value-at-risk, financial portfolioAbstract

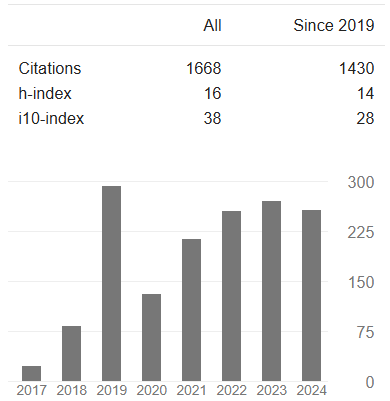

Genetic algorithms are optimization methods that are primarily used in financial analysis to facilitate better hands-on analysis with various software packages. The traders can use the parameters set, which are then applied using genetic algorithms for optimization. The financial applications optimize the parameters to represent the risks to the traders using evolutionary methods. Fixing the parameters is an essential step in the evolutionary process, and the financial parameters should correlate to modifications with market turns. This research focuses on determining the financial rank of supermarkets using clustering and evolutionary algorithms to identifythe risks in various decision-making and multi-disciplinary applications. This research also analyzes the optimal investment and some strategies required for consumption in asset modeling. The decision maker may fail in information processing due to the cost and can make financial portfolio decisions based on the signals observed. Hence this research developed the optimization model using clustering and evolutionary algorithms to determine the strength of observation, consumption strategies, and optimal investment based on the constraint value-at-risk and the cost of information processing. The wealth proportion spent by an investor on consumption lies between 0.01 and 0.09. Under the value-at-risk assumption, the stability of the optimal consumption proportion is inferred over the long-run period and will not exceed 7% of the investor's overall wealth.The experimental results prove that the proposed model works better than the state-of-the-art methods.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2023 International Journal of Pharmacy Research & Technology (IJPRT)

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.